The Single Strategy To Use For Personal Loans Canada

Table of Contents6 Easy Facts About Personal Loans Canada DescribedPersonal Loans Canada Things To Know Before You BuyThe Ultimate Guide To Personal Loans CanadaThe Definitive Guide to Personal Loans Canada5 Easy Facts About Personal Loans Canada Described

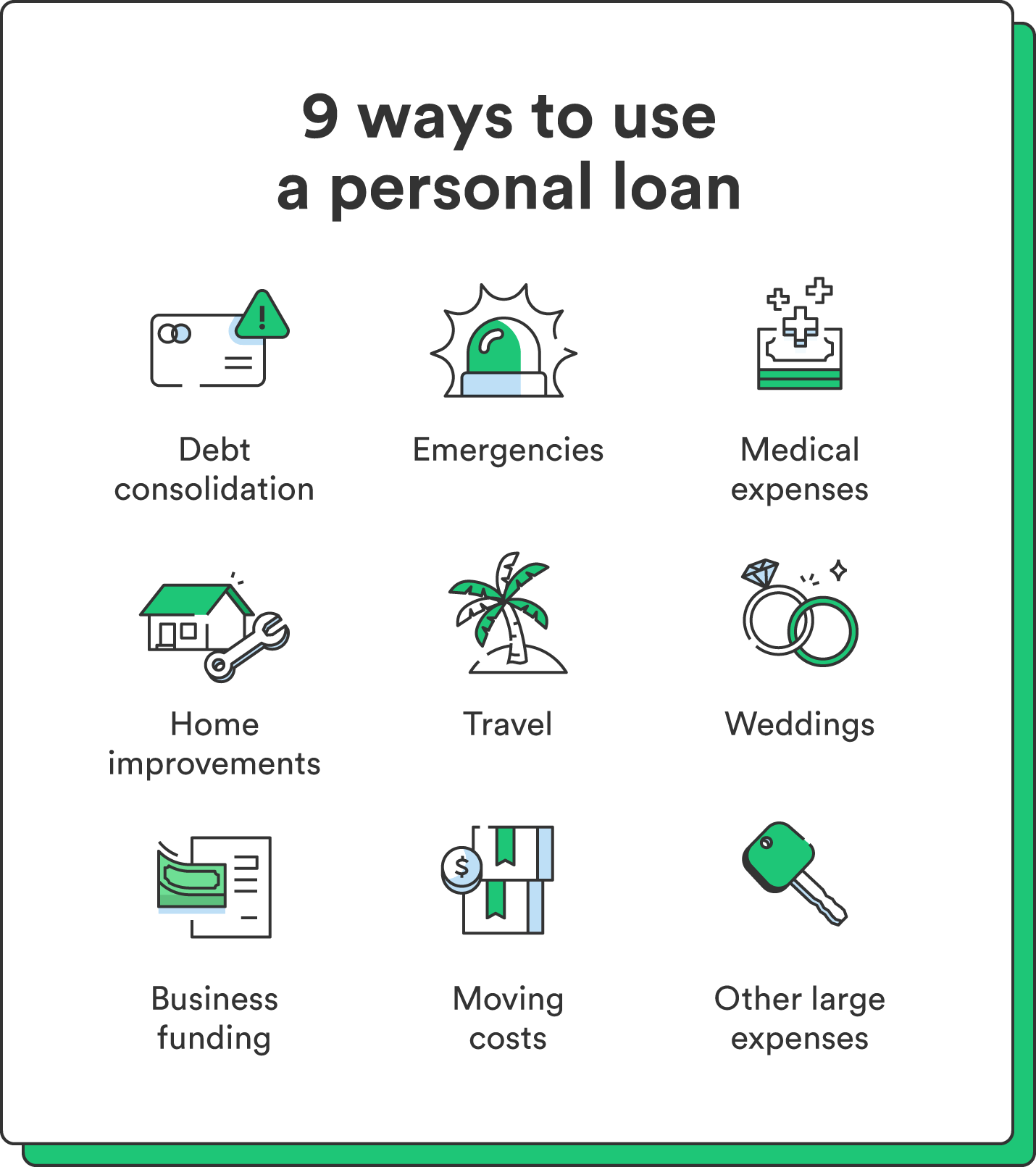

Settlement terms at most personal funding lenders range between one and 7 years. You receive every one of the funds at as soon as and can utilize them for almost any kind of objective. Consumers frequently use them to fund a possession, such as an automobile or a boat, pay off debt or assistance cover the price of a significant expense, like a wedding event or a home renovation.

Individual loans come with a taken care of principal and passion regular monthly payment for the life of the car loan, calculated by adding up the principal and the passion. A set rate gives you the security of a foreseeable monthly settlement, making it a preferred option for consolidating variable price bank card. Repayment timelines differ for individual finances, however customers are usually able to pick payment terms in between one and 7 years.

Personal Loans Canada Can Be Fun For Everyone

The charge is typically deducted from your funds when you complete your application, lowering the amount of cash you pocket. Personal finances prices are extra straight tied to short term rates like the prime rate.

You may be supplied a reduced APR for a much shorter term, due to the fact that lenders understand your balance will be settled much faster. They might bill a greater price for longer terms understanding the longer you have a lending, the more probable something can transform in your funds that could make the payment expensive.

A personal finance is additionally a great option to utilizing bank card, because you borrow money at a fixed price with a precise payback day based upon the term you select. Remember: When the honeymoon is over, the monthly settlements will certainly be a pointer of the money you spent.

The Best Strategy To Use For Personal Loans Canada

Before tackling financial debt, utilize an individual funding repayment calculator to aid budget plan. Gathering quotes from numerous lending institutions can aid you spot the very best bargain and potentially conserve you interest. Compare passion rates, charges and loan provider reputation before looking for the finance. Your credit rating is a huge consider determining your eligibility for the financing in addition to the interest rate.

Prior to applying, know what your score is to ensure that you understand what to anticipate in regards to prices. Watch for concealed costs and fines by reading the loan provider's terms web page so you do not wind up with much less cash money than you require for your economic goals.

Personal car loans need evidence you have the credit history account and revenue to repay them. Although they're much easier to certify for than home equity finances or other safe loans, official source you still need to reveal the lender you have the methods to pay the loan back. Individual lendings are far better than charge card if you want an established regular monthly payment and require all of your funds simultaneously.

Some Known Details About Personal Loans Canada

Credit scores cards may likewise supply incentives or cash-back alternatives that personal loans don't.

Some lenders may also charge costs for individual loans. Individual financings are financings that can cover a number of personal costs. You can locate personal loans via financial institutions, cooperative credit union, and online lending institutions. Individual car loans can be protected, indicating you need security to borrow money, or unsecured, with no security needed.

, there's generally a fixed end day by which the car loan will be paid off. A personal line of credit history, on the other hand, might continue to be open and offered to you forever as long as your account stays in excellent standing with your lending institution.

The cash gotten on the lending is not tired. If the loan provider forgives the financing, my company it is considered a canceled debt, and that quantity can be tired. Individual lendings might be protected or unsafe. A safeguarded individual car loan needs some kind of collateral as a problem of loaning. For instance, you might safeguard a personal car loan with cash assets, such as an interest-bearing account or certification of down payment (CD), or with a physical possession, such as your auto or boat.

Getting The Personal Loans Canada To Work

An unsecured individual funding calls for no security to obtain money. Financial institutions, credit score unions, and online lending institutions can supply both secured and unprotected personal finances to certified borrowers.

Again, this can be a financial institution, debt union, or on the internet individual financing lending institution. If approved, you'll be offered the financing terms, try this out which you can accept or reject.